In the fast-paced realm of financial technology, the annual Fintech Nexus conference is widely anticipated by industry professionals and enthusiasts alike. Fintech Nexus 2023 proved to be a captivating event, showcasing the latest advancements, trends, and collaborations in the world of fintech.

Let’s take a closer look at three of the pervading themes from this groundbreaking conference.

Embracing Blockchain and Cryptocurrency

One of the prominent themes at Fintech Nexus 2023 was the continued rise of blockchain technology and its integration into mainstream financial services. Industry leaders showcased various use cases for blockchain, including secure payments, supply chain management, and decentralized finance (DeFi). Cryptocurrency also took center stage, with discussions on regulation, institutional adoption, and the future of digital currencies.

Open Banking and API Revolution

Open banking, a concept that promotes data sharing between financial institutions and third-party providers, was a hot topic at the conference. Experts emphasized the potential for increased innovation and customer-centric solutions through open APIs (Application Programming Interfaces). The discussions explored how this ecosystem can revolutionize traditional banking, accelerate financial inclusion, and create personalized experiences for customers.

Artificial Intelligence (AI) and Machine Learning (ML) Advancements:

AI and ML continue to shape the fintech landscape, and Fintech Nexus 2023 showcased some remarkable advancements in this field. Conversational AI-powered chatbots, robo-advisors, and fraud detection systems were just a few of the cutting-edge solutions presented. The discussions revolved around ethical AI, responsible data usage, and the role of human expertise in an AI-driven world.

Exhibiting Companies

In addition to interesting panels, there were many companies that are a part of the current momentum and future of finance that exhibited at the conference.

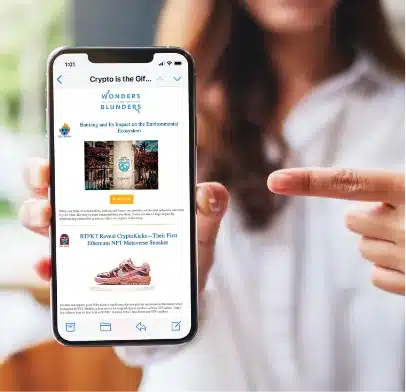

Argyle

Argyle is a payroll connectivity platform for modern financial services. Its direct-source portability tools service mortgage, lending and banking service providers. For consumers, it’s a friendly user experience where they can link their payroll platform directly into the service providers application so they don’t have to present paper documents or worry if their employer will verify their employment over the phone. Argyle announced it had added over 35 new customers to its payroll connectivity platform since the beginning of the year, and released the second version of its platform, Argyle 2.0, for faster and more instant connections.

The Argyle booth featured a “spot the fake paystub” activation where people choose which one they think is the fake paystub. Fake paystubs are an issue in income and employment verification that Argyle helps solve by digitizing the whole process.

Argyle also hosted the official Fintech Nexus afterparty at The Knickerbocker rooftop – it was a great night!

New Silver is a fintech startup that sits at the intersection of decentralized finance and real-world assets. It is a non-bank lender that focuses on funding the “fix and flip” sector with a concentration on single-family residential and small-balance commercial assets. Loan originations are streamlined through New Silver’s proprietary technology, utilizing data to reduce loan default risk. The FlipScout tool uses intelligence to highlight real estate investment projects with the highest ROI for investors.

Pictured at the New Silver booth from left to right: John Coury, Head of Capital Markets; Carmel Woodman, Content and PR Manager

Also exhibiting was Array, a financial innovation platform that helps digital brands, financial institutions, and fintechs move compelling consumer products to market faster. Its white-label offerings including credit monitoring, privacy, credit-building tools, and digital finance tools help companies offer these services to their customers without having to invest internal teams’ time to bring it to market. Array’s solutions are also regulatory compliant, so companies have peace of mind that they are providing a legitimate solution to their customers.

Fintech Nexus 2023 demonstrated that the future of financial technology is both exciting and transformative. From blockchain and cryptocurrency to AI and sustainable finance, the conference showcased the vast potential of fintech to revolutionize the way we bank, invest, and access financial services. As the industry continues to evolve, collaboration, innovation, and responsible practices will shape the path ahead, ushering in a new era of inclusive, secure, and customer-centric financial technology.